social security tax rate 2021

The employees Social Security payroll tax rate for 2021 January 1 through December 31 2021 is 62 of the first 142800 of wages salaries etc. The Social Security tax rate for those who are self-employed is the full 124.

Final Regs On Income Tax Withholding On Certain Periodic Retirement And Annuity Payments

Fortunately Social Security benefits are adjusted for inflation on an annual basis and recipients will get a historic 87 cost-of-living adjustment COLA in 2023.

. The wage base is adjusted periodically to keep pace. Employees have 62 percent of earnings deducted from their paychecks and the. All wages and self-employment income up to the Social Security wage base are subject to the 124 Social Security tax.

For married couples filing jointly you will pay taxes on up to 50. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. 2 Regulations 2022 increased the rate of NICs as follows.

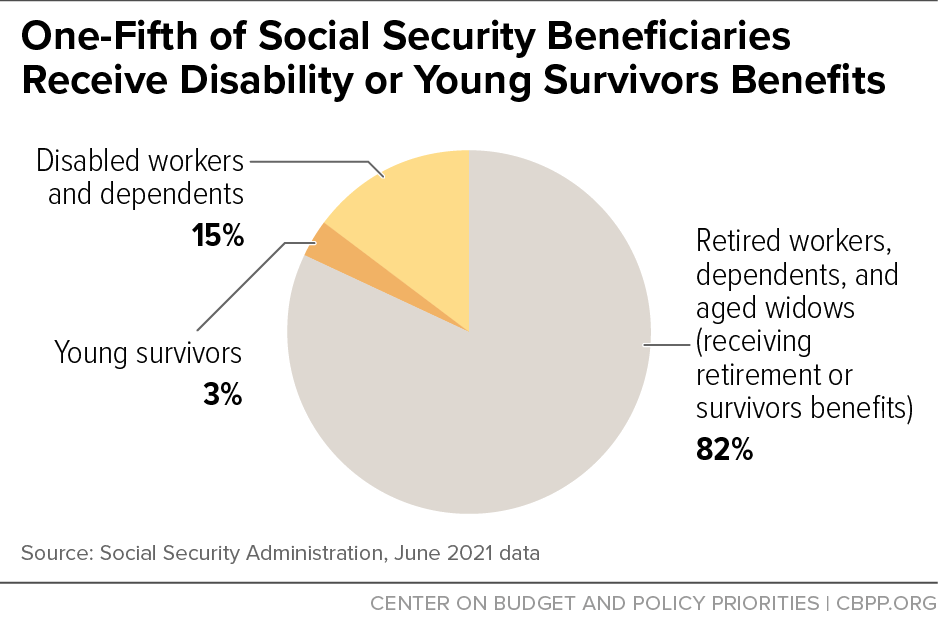

The current rate for Medicare is 145 for the employer and 145. If your combined income is more than 34000 you will pay taxes on up to 85 of your Social Security benefits. 2021 Social SecuritySSIMedicare Information Social Security Program Old Age Survivors and Disability Insurance OASDI 2021 Maximum Taxable Earnings.

Federal SSI payment levels will also. Maximum rate Class 2 contribution. From 6 April 2022 the HSCL Act 2021 and the Social Security Contributions Amendment No.

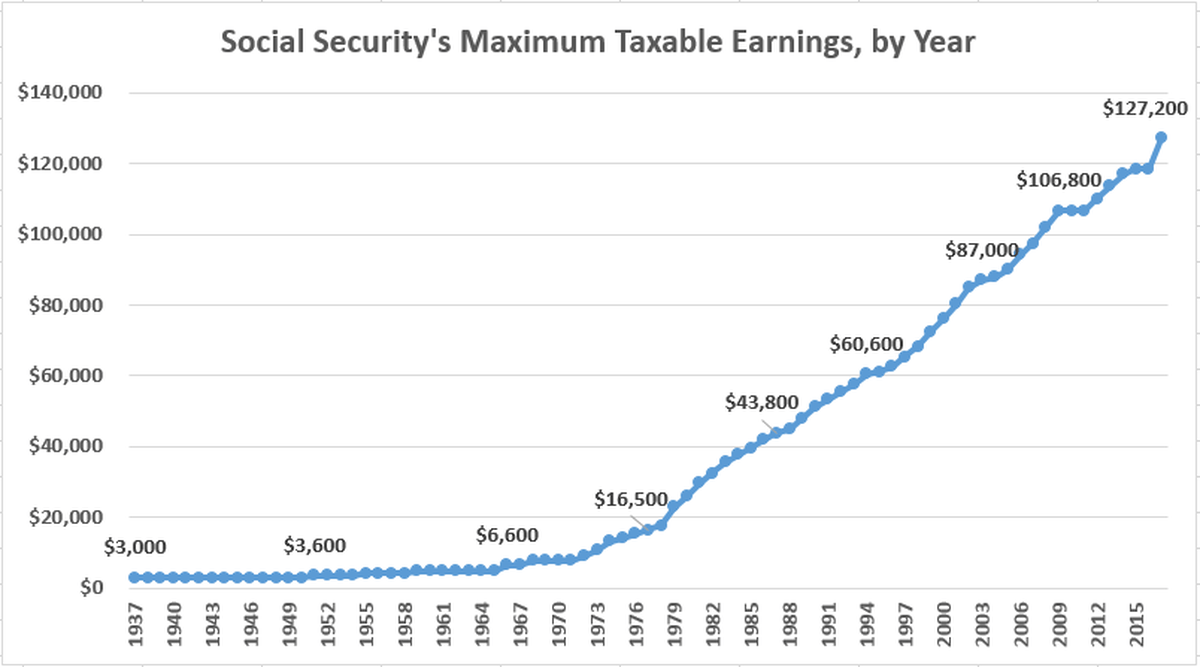

More than 44000 up to 85 percent of your benefits may be taxable. Single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security payments for the 2021 tax year which you will file in. There is a limit on the amount of annual wages or earned income subject to taxation called a tax cap.

An employees 2021 earnings in excess of. Czech Republic Czechia 3380. In 2023 the Social Security tax rate is 62 for the employer and 62 for the employee.

For the 2021 tax year single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. If your combined income. 50022 October to December.

92422 October to December. Social Security benefits will increase by 59 percent beginning with the December 2021 benefits which are payable in January 2022. Medicare taxes are split between the employer and the employee with a total tax.

Earnings up to a maximum 137700 in calendar year 2020 are taxed at a rate of 124 percent. For both 2021 and 2022 the Social Security tax rate for employees and employers is 62 of employee compensation for a total of 124. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax.

Those who are self-employed are liable. Social Security taxes in 2022 are 62 percent of gross wages up to 147000. Here is a brief overview of 2021 tax rates and social security contributions in Bulgaria.

The corporate tax rate remains at 10 in 2021. For 2021 the first 142800 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad. 62 of each employees first 142800.

Thus the most an individual employee can pay this year is 9114 Most workers. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. 59550 January to September.

Tax Amount Increases For 2021 Trueblaze Advisors

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap As Usa

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

Higher Earners Will Pay More Social Security Tax In 2021 The Motley Fool

Presidential Tax Rate Proposal Mullin Barens Sanford Financial

Social Security And Taxes Could There Be A Tax Torpedo In Your Future Apprise Wealth Management

Reduced Corporate Income Tax Rates For Small Businesses In Europe

Social Security Benefits Increase In 2021 Integrated Tax Services

Maximum Taxable Income Amount For Social Security Tax Fica

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

2021 Federal Payroll Tax Rates Abacus Payroll

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

13 States That Tax Social Security Benefits Tax Foundation

Social Security Tax Impact Calculator Bogleheads